You already know that having good food and a full dining room isn’t enough to run a restaurant. Smart restaurant operators know that having a clear understanding of the numbers and the data is the most important part. Without the correct data, it’s hard to make informed choices and plan for growth.

Whether you’re tracking cash flow, managing payroll, or keeping up with inventory costs, your accounting process holds the key to long-term stability. In this guide, we’ll walk through the fundamentals of restaurant accounting, why it’s important, and how the right systems can help you turn your back office into a more efficient, profitable part of your business.

How to Understand Restaurant Accounting

Keeping track of all the money that comes in and out of your restaurant is part of restaurant accounting. This includes everything from daily sales and labor costs to vendor payments and inventory counts.

But it’s not just about keeping records. It’s about looking at your data to uncover patterns, spot dangers early, and get a better idea of your finances. It helps with better planning, wiser budgeting, and stronger compliance when done effectively.

When costs change all the time and margins are tight, having a good accounting system is not an option; it is a need. People who put a high value on financial clarity, whether they work for themselves or for a multi-unit business, are better able to grow and adapt in an industry that is always evolving.

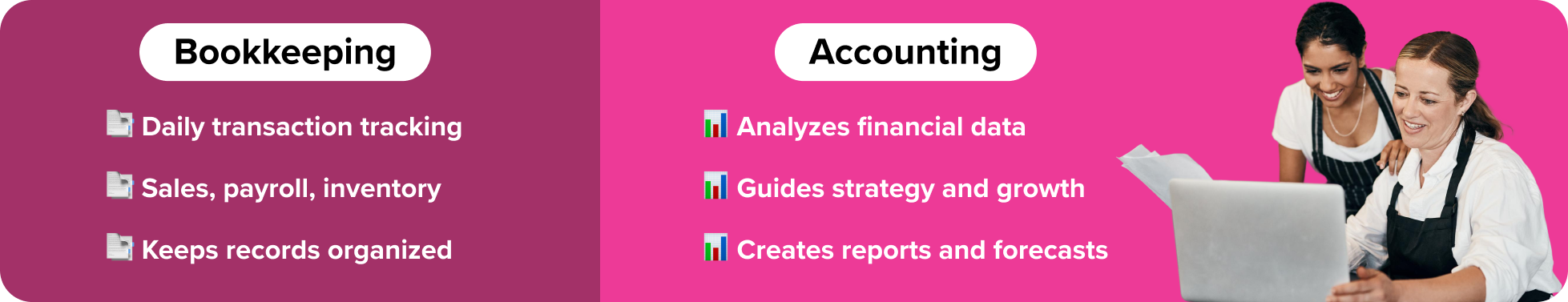

Restaurant Bookkeeping vs Restaurant Accounting

People commonly confuse bookkeeping with accounting, although they are not the same. Keeping track of daily tasks like reporting sales, registering purchases, updating payroll, noting changes in inventory, and ensuring sure vendor payments are recorded correctly is what bookkeeping is all about.

It’s something you do every day, and it’s very important. Good bookkeeping keeps your financial records accurate and up-to-date, which gives you the information you need to make wise business decisions in the future.

Accounting takes things a step further. It’s where strategy starts to take shape. Using the information collected through bookkeeping, accountants build reports, look at financial trends, project future cash flow, and help guide important decisions.

Accounting goes a step further. It’s where strategy begins to take shape. Accountants use the information they get from bookkeeping to make reports, look at financial trends, predict future cash flow, and help people make key decisions.

Your bookkeeper keeps track of daily labor costs, for example. An accountant might look over such information and see a pattern of extra hours or shifts that aren’t worth the money. Bookkeeping keeps things going. Accounting tells you what to do next.

Why Restaurant Accounting Matters

Good accounting isn’t just about getting through tax season. When done well, it helps you grow instead of just following the rules. This is what good financial management can truly achieve for your restaurant:

- Help You Spot Problems Early – With clear reports and regular reviews, you’ll catch issues like rising costs or shrinking margins before they turn into bigger problems.

- Support Smarter Decisions – Accurate numbers help you make informed choices about staffing, pricing, purchasing, and more.

- Improve Cash Flow – Tracking what’s coming in and going out gives you a better handle on your day-to-day financial health and helps avoid surprises.

- Strengthen Vendor Relationships – Paying on time and understanding your costs helps build trust with suppliers and gives you more leverage when it comes to negotiating.

- Make Growth Sustainable – Whether you’re opening a new location or expanding your menu, having solid financial systems in place makes scaling feel a lot less risky.

Restaurant-Specific Accounting Considerations

There are several financial problems that arise with running a restaurant that don’t happen in most other businesses. Restaurants have to cope with thin margins, perishable goods, and costs that change all the time, which is different from retail or office work. That means your accounting system needs to do more than just keep track of the basics.

Here are some crucial things to keep an eye on:

- Prime Cost Monitoring: This combines your food, beverage, and labor costs. It’s one of the most important numbers to track. Ideally, prime cost should stay below 60 to 65 percent of total sales if you want to remain profitable.

- How You Value Inventory: The method you use, such as FIFO (First In, First Out), LIFO (Last In, First Out), or a weighted average, can affect your food cost calculations and financial reporting. It’s important to choose the right fit for your operation and stick with it.

- Tips and Payroll: Restaurants rely heavily on tipped staff. You need to track tips accurately, not just for compliance, but to make sure your team is paid fairly and your taxes are in order.

- Revenue Channels: You’re not just selling meals at the table anymore. There’s POS, online ordering, delivery apps, catering, events – the list goes on. Each one comes with its own set of fees and reporting quirks.

- Sales Tax Complexity: Different ordering methods and locations often mean different tax rules. Your accounting setup should be able to adapt and calculate those correctly.

- Franchise or Multi-Unit Reporting: If you’re part of a group or franchise, you’ll likely need standardized templates, location-level reports, and audit-ready records. That requires more structure than a single-unit setup.

- Seasonality and Waste: Restaurants experience shifts in traffic and menu offerings throughout the year. Add in the risk of spoilage, and forecasting becomes even more critical.

All of this makes it clear that restaurant accounting isn’t one-size-fits-all. You need tools and systems built for the specific demands of the foodservice world.

Outsourced vs In-House Restaurant Accounting

The size, structure, and resources of your restaurant will frequently determine whether you handle accounting in-house or hire an outside staff.

Keeping It In-House

If you have an experienced finance team or need hands-on control over every detail, managing accounting internally can make sense. You’ll have immediate access to your financial data and the ability to adjust quickly as things change. This approach often works well for larger or more established operations.

Outsourcing the Work

Outsourcing can be a good idea for a lot of small or expanding restaurants. You can hire experienced specialists who know restaurant accounting inside and out without having to pay for a full team. It also saves time and can help you avoid making expensive blunders.

Finding a Happy Medium

Some operators prefer to do a little of both. For instance, they might do their own bookkeeping every day but hire someone else to handle payroll, taxes, or end-of-month reports. This hybrid concept is flexible and can grow with your needs.

Common Accounting Challenges and How to Stay Ahead of Them

Accounting isn’t always second nature to restaurant operators, and that’s okay. But a few common pitfalls can cause real headaches if left unchecked. Here’s what to watch for and how to avoid trouble before it starts:

Too Much Manual Entry

Typing in receipts or invoices by hand takes time and leaves room for mistakes. Using software that connects your POS, vendors, and accounting tools can help cut down on errors and free up your time.

Falling Behind on Reconciliation

If you wait too long to match up your records with your bank statements, small issues can snowball. Aim to reconcile regularly, weekly or monthly, so nothing slips through the cracks.

Messy or Inconsistent Reports

Without consistent financial reports, it’s hard to see how your restaurant is really doing. Set up templates or dashboards to track your numbers the same way every time. It makes trend-spotting and decision-making easier.

Invoice Confusion

It’s surprisingly easy to pay the same invoice twice or miss one entirely. Use tools that help you organize and track vendor payments so you stay on top of what’s owed and when.

Not Feeling Confident With the Numbers

Many great restaurant owners excel at food and hospitality, but financials feel like a different world. Don’t be afraid to ask for help. Whether it’s staff training or bringing in an outside expert, support is out there.

With the right systems and a little structure, these challenges become easier to manage and a lot less stressful.

Key Financial Reports You Need

To manage your business effectively, you need consistent access to core financial reports:

1. Profit and Loss Statement (P&L)

Shows your total revenue, expenses, and net profit over a set time period. Essential for tracking profitability.

2. Balance Sheet

A snapshot of your financial health detailing assets, liabilities, and equity at a point in time.

Reveals when and how cash enters and leaves your business, helping manage liquidity and avoid cash crunches.

4. General Ledger (GL)

A complete, categorized log of every financial transaction, which is vital for audits and deep analysis.

5. Accounts Payable & Receivable

Help manage outgoing bills and track unpaid invoices to improve cash flow.

6. Sales & Labor Reports

Provide insights into performance by shift, daypart, or menu item, supporting better scheduling and pricing.

Regularly reviewing these reports equips you to spot issues early and plan for growth.

Restaurant Accounting KPIs to Track

Tracking financial KPIs helps you measure performance and identify where to pivot. Key restaurant accounting KPIs include:

- Prime Cost: The combined cost of goods sold and labor. Target: under 65% of total sales.

- Food Cost %: Reveals how much of your revenue goes to food purchases.

- Labor Cost %: Helps monitor staffing efficiency and overtime trends.

- Overhead Ratio: Measures fixed costs like rent and utilities versus total revenue.

- Inventory Turnover: Tracks how quickly inventory is used and replenished.

- Break-Even Point: Shows how much revenue is needed to cover all expenses.

Monitor these KPIs weekly or monthly to keep your financial health in check.

Choosing the Right Accounting Method for Your Restaurant

When it comes to tracking your finances, restaurants typically choose between two main methods, and the one you pick can make a big difference in how you view your business.

Cash Accounting

This method records income and expenses when money actually changes hands. It’s straightforward and works well for smaller restaurants that mostly deal in cash or immediate payments.

Accrual Accounting

With this method, you log revenue and expenses when they’re earned or owed, not when the cash hits your account. It gives you a more complete picture of your financial health, especially over time. For restaurants that have contracts, use credit terms, or are expanding, accrual accounting usually makes more sense.

As your operation grows, the accrual method often becomes the better fit. It lines up more accurately with payroll schedules, vendor billing, and long-term planning.

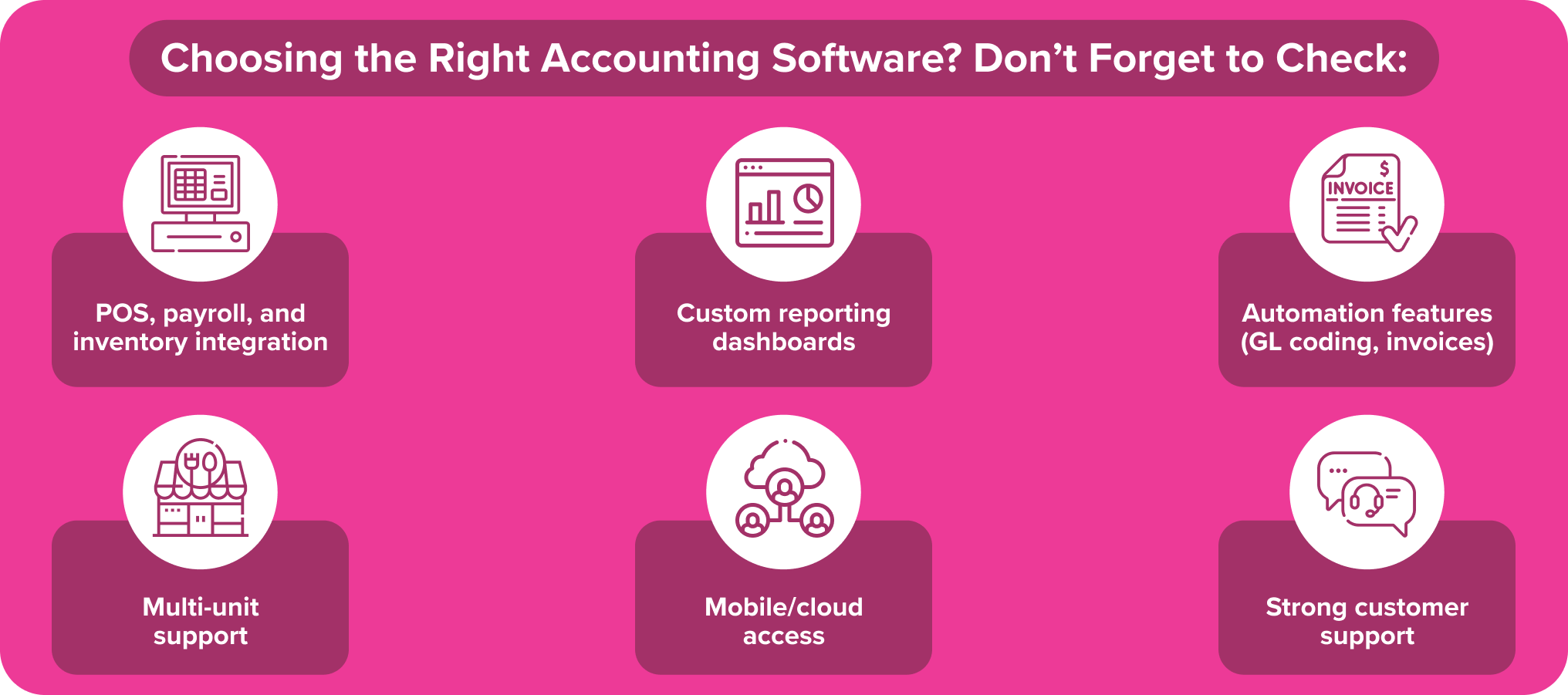

How to Choose the Right Restaurant Accounting Software?

The best accounting software for your restaurant depends on your size, goals, and tech stack. Key features to look for:

- POS Integration: Seamless connection with your point-of-sale system for automatic sales reporting.

- Payroll and Inventory Sync: Link with your labor scheduler and inventory tools for real-time cost tracking.

- Customizable Reporting: Dashboards and templates tailored to restaurants make it easier to monitor KPIs.

- Automation: Features like invoice scanning, GL coding, and expense categorization save time and reduce errors.

- Multi-Unit Functionality: Ensure the platform can handle consolidated reports and location-specific insights.

- Mobile Access: Cloud-based systems allow owners to manage finances from anywhere.

- Support and Training: Look for vendors that offer onboarding, help centers, and customer service.

Popular options include QuickBooks, Xero, and Back Office by Buyers Edge Platform, which is designed specifically for foodservice operations.

How Buyers Edge Platform Help You?

Buyers Edge Platform simplifies restaurant accounting by combining procurement and financial management into one streamlined ecosystem. Our solutions include:

- Back Office software with GL coding, invoice automation, and real-time reporting

- POS, payroll, and inventory integration for seamless data flow

- Rebate tracking and price verification to recover dollars and ensure accuracy

- Multi-unit dashboards for consolidated and unit-level visibility

Whether you’re an independent restaurant or managing multiple locations, Buyers Edge Platform equips you with the tools to reduce costs, improve accuracy, and boost your bottom line.

FAQs

1. What’s the difference between restaurant bookkeeping and accounting?

Bookkeeping tracks daily transactions. Accounting analyzes that data for insights and strategy.

2. Do I need accounting software if I have a POS?

Yes. POS systems track sales, but accounting software provides full financial visibility, including expenses, payroll, and forecasting.

3. How often should I review financial reports?

Review labor and sales weekly, and key financial statements like P&L and cash flow monthly.

4. What’s the best accounting method for restaurants?

Accrual accounting is preferred for most operators, offering a more accurate financial view. Smaller restaurants may still use cash accounting.

5. Should I hire a bookkeeper or an accountant?

If you’re growing or multi-unit, an accountant brings strategic value. A bookkeeper is ideal for daily records and smaller operations.

6. How do I track prime cost effectively?

Use integrated software that pulls data from your labor and inventory systems to monitor in real-time.

7. Can I outsource restaurant accounting?

Absolutely. Outsourcing saves time, reduces errors, and gives you access to expert insights and financial strategy.

8. What if I operate multiple concepts or units?

Choose software with centralized dashboards and unit-specific reporting to simplify oversight and comparison.