Foodservice Operator Support Center

Our Support Center has everything Operators need to remain connected. Weekly Commodity Reports, Supply Chain Hot Takes, and Produce Alerts – ready to review!

Commodities Snapshot Report

For the week of February 23, 2026

Quickly review the latest weekly snapshot on all major commodities!

And for a deeper dive, scroll to the CommodityONE Reports below.

-

Grains

Soybeans and wheat extended their rally, while corn slipped slightly after failing to break above $4.40. Speculative fund activity appears to be contributing to recent strength, particularly in soybean oil, despite large stock levels and uncertainty around 2026 biofuel blending targets.

Outlook: Grain markets may remain volatile as policy decisions and fund activity drive price swings. Operators should expect continued choppiness rather than clear directional trends in the short term.

-

Beef

Cattle futures pushed higher with February contracts reaching $247.50/cwt, while choice and select cutouts softened slightly. Rib and loin cuts posted modest gains, including boneless heavy ribeye at $10.79/lb, while chuck rolls slipped to $4.82/lb. Ground beef 81% moved higher to $3.69/lb. Harvest volumes remain slightly lower, continuing to lend support to boxed beef values.

Outlook: Despite February’s typical seasonal demand lull, tighter harvest levels and strong forward brisket sales should keep beef prices supported. Operators may continue to see firmness in middle meats and briskets as we move toward spring demand.

-

Dairy

Cheese prices climbed, with CME blocks up to $1.51/lb and barrels at $1.47/lb. Butter increased to $1.78/lb, though year-to-date butter remains significantly below last year and the five-year average. Production is running near capacity, and export demand is providing additional support.

Outlook: Growing manufacturing output is helping keep dairy competitive globally, but moderate foodservice demand and steady exports suggest prices may hold firm in the near term rather than spike sharply.

Click Show More to view Poultry, Pork and Seafood.

-

Poultry

USDA young chicken harvest jumped to 178.4 million head, up 6.4% week over week and 5.6% year over year, helping stabilize most major cuts. Boneless skinless breasts ticked up to $1.47/lb (up 16.5% month over month but still down 11% year over year), wings held at $1.21/lb, and thigh meat continues to post year-over-year gains. Turkey markets remain significantly elevated due to ongoing HPAI-related supply constraints, while egg prices fell week over week.

Outlook: With harvest volumes rebounding after earlier storm disruptions, chicken prices appear to be moderating. Expect relative stability in most cuts near term, though turkey and eggs will remain sensitive to disease pressures and supply disruptions.

-

Pork

The pork cutout edged higher to $96.28/cwt with strength across several primals. Boneless pork butts rose to $1.47/lb, supported by strong international movement, including 169 loads sold last week. Bellies and ribs posted gains, while retail demand remains soft. Lower harvest volumes provided additional support.

Outlook: Pork is expected to trend steady to slightly firmer in the coming weeks. While domestic retail demand is soft, rebuilding freezer inventories and improving export activity should help maintain price stability.

-

Seafood

Frozen Alaskan pollock prices jumped 18.3% month over month in December trade data, reaching their highest point since last February. The market has rebounded faster than expected after 2025’s sharp declines.

Outlook: Prices are expected to soften in March, potentially dipping toward the $1.40/lb range in April before gradually climbing again later in the year. Extreme volatility seen in prior years may ease somewhat, though swings remain likely.

Past Reports

Commodities Report

Commodities Report

Commodities Report

Commodities Report

Menu Makers is a weekly tip series with the hottest and

most trendy menu items.

Click the play button on the left to watch the latest video,

or click the thumbnails below to review archived uploads.

Past Videos

Weekly Produce Reports

Weekly reports for all regions. Current conditions, market trends, historic projections, insider alerts – and all at your fingertips!

February 26, 2026 – Tight market conditions continue across the vegetable category. Cool weather in Mexico and the freeze in Florida continue to impact production of Tomatoes, Cucumbers, Squash, Beans, Bell Peppers, and Corn. Supply chain challenges, including limited equipment, driver delays, and …

Past Reports

Produce Alliance Market Report

Produce Alliance Market Report

Produce Alliance Market Report

Produce Alliance Market Report

Weekly Commodity Reports

Detailed Commodity Reports and video Hot Takes from ArrowStream, for those in need of more in-depth reporting.

CommodityONE Market Report

In search of more detailed insight? Look no further than ArrowStream’s multi-page weekly CommodityONE Report.

Complete and submit the following form to receive your full report.

CommodityONE Hot Takes

Paul Savage, Director of Commodities at ArrowStream, presents the latest CommodityONE Hot Takes.

Click the play button to watch the latest video,

or click the thumbnails below to review archived uploads.

Past CommodityONE Updates

Step inside the foodservice world with Grounded, where we sit down with industry leaders to explore their personal journeys, business challenges, and big-picture perspectives from sourcing to service.

Hit play to watch the latest episode, or browse past conversations using the thumbnails below.

Foodservice Operator News

Check out insights and tips produced by experts from the Buyers Edge Platform family of brands.

- All

- Articles

- Data / Technology

- Digital Procurement Network / GPO

- Fresh Solutions / Fresh Division

- Supply Chain

How to Manage Labor Cost in the Restaurant Industry

Source: InsideTrack

How Restaurant Rebates Work and Why They Matter for Growing Restaurant Brands

Source: Consolidated Concepts

Restaurant Supply Chain Management: A Comprehensive Guide

Source: Buyers Edge Platform

Food Service Contracts: What Restaurants Should Look For

Source: InsideTrack

Biggest Hospitality Industry Challenges and How to Solve Them

Source: Buyers Edge Platform

Restaurant Inflation: Why Costs Keep Rising & What Owners Can Do

Source: InsideTrack

Restaurant Equipment Checklist: Everything You Need to Know

Source: Dining Alliance

Stay up to date

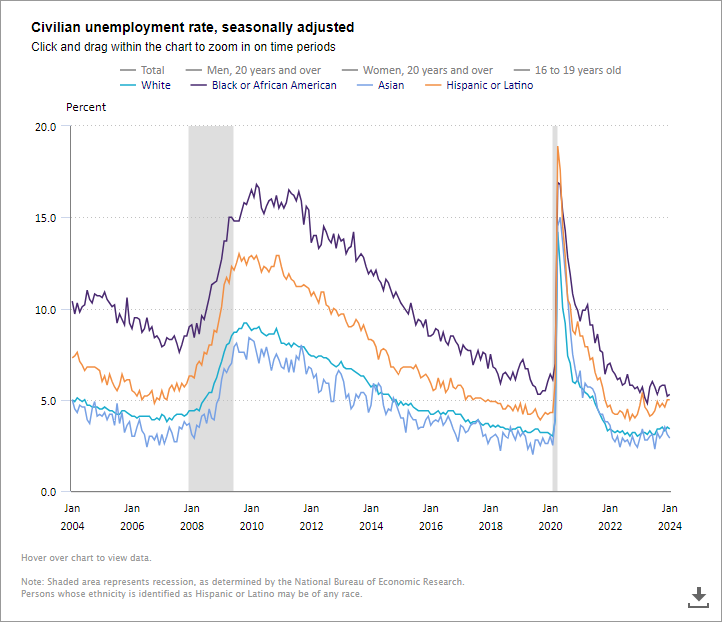

The Latest Facts & Figures

Live, interactive charts from industry experts

Click the thumbnails below to explore the latest data in each.

Then click the headings at the top to show or hide the different groups and categories.

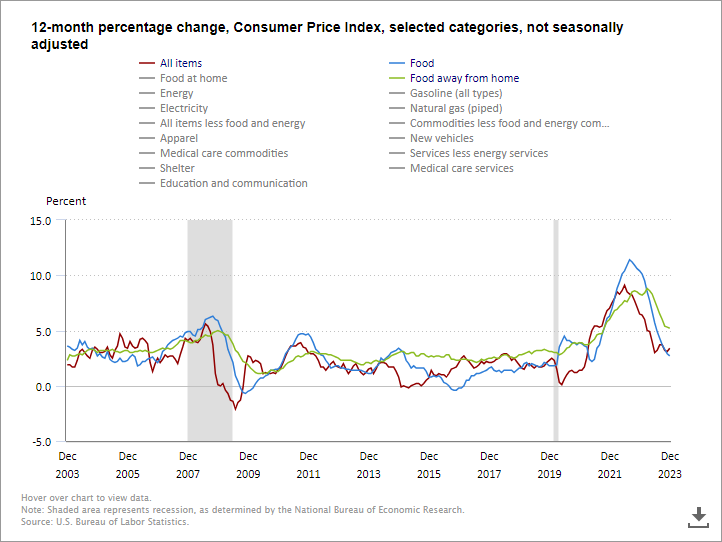

Consumer Price Index

Track the 12-month percentage changes of various goods and services.

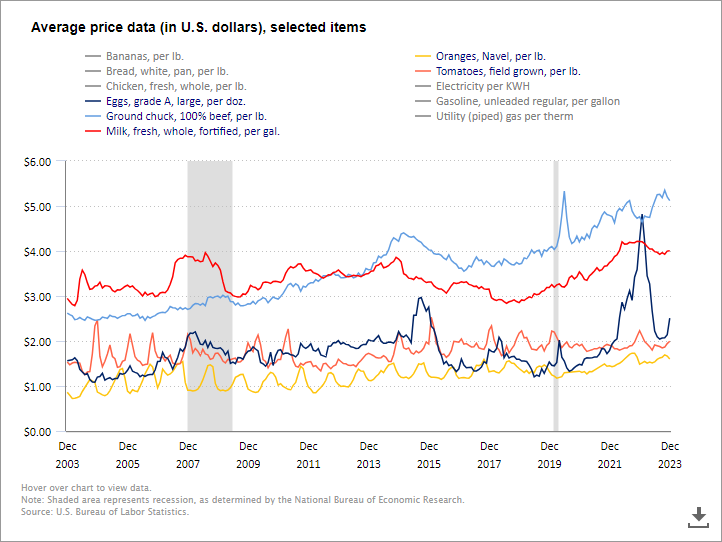

Price Data

Track the price changes of key indicators including meat, produce and dairy.

Questions?

Contact our Team of Foodservice Experts

Submit this short form and an expert from the Buyers Edge Platform will reach back out to address your foodservice related questions or concerns.

Drop Us a Line

We will respond within 1-2 business days.