Foodservice Operator Support Center

Our Support Center has everything Operators need to remain connected. Weekly Commodity Reports, Supply Chain Hot Takes, and Produce Alerts – ready to review!

Commodities Snapshot Report

For the week of June 30, 2025

Quickly review the latest weekly snapshot on all major commodities!

And for a deeper dive, scroll to the CommodityONE Reports below.

This week’s snapshot report is taking a brief pause.

Fresh insights will be back next week—stay tuned.

-

Grains & Oilseeds

Winter wheat surrendered the prior week’s geopolitically driven gains, and soybean oil followed crude lower despite a bullish long-term biofuel outlook. Traders braced for potentially bearish acreage and stocks data in today’s USDA reports, which could dictate short-term direction. The wheat harvest is still 9 % behind average, yet prices shrugged, signaling fundamental supply comfort.

Outlook: Near-term volatility hinges on the fresh USDA numbers; longer-run soy-oil bias stays modestly higher, but soybean fundamentals now call the tune.

-

Beef

Live cattle futures eased 1.5 %, yet the choice cutout pushed to $395/cwt on strength in ground beef and lean trim—50 % trim hit a record $2.34/lb. Middle meats (ribs, loins) softened slightly, while end cuts showed a mixed bag. Packers may pare harvests to temper cash cattle, but momentum in the beef complex remains bullish.

Outlook: Prices likely climb into next week before hitting the seasonal peak; plan any July grilling features now and lock in ground beef needs early.

-

Dairy

Spot butter crept to $2.54/lb on robust export pull, even as retail promotions cooled. Cheese blocks and barrels slipped to the mid-$1.60s, with milk flows easing but still ample for production. Cream supplies are tight in parts of the West and Central regions, giving butter makers just enough to stay busy.

Outlook: Butter remains underpinned by global demand, while cheese looks range-bound until back-to-school and tailgate season pick up later this summer.

Click Show More to view Poultry, Pork and Seafood.

-

Poultry

Young-bird harvests ran 3.6 % ahead of last year, keeping whole-bird values flat while boneless/skinless breasts tumbled $0.26 to $2.39/lb and wings inched up to $1.26/lb (still half of 2024’s price). Dark-meat items slipped modestly, and the egg index rose 1 % after a 10 % slide in May. Overall supply is healthy, but limited harvest growth is preventing a true glut.

Outlook: Expect the normal midsummer dip in pricing, yet budget-friendly white meat should stay resilient as retailers and foodservice lean on chicken for value-driven promos.

-

Pork

The composite cutout gained 1 % (up 14 % in June) as bellies climbed another 4 % and tenderloins firmed, though loins and butts were mostly flat. Export interest in butts waned, and trim values slipped—signs the rally is tiring. Futures and cash hogs are starting to diverge, hinting at cooler heads ahead.

Outlook: Many primals appear near their summer highs; look for modest price relief in July but keep an eye on tariff decisions when the 90-day pause expires.

-

Seafood

Frozen cod filets notched a fresh record at $4.89/lb—up 27 % year-over-year—marking five straight monthly gains. April typically represents the seasonal ceiling as imports trough, so this jump was bigger than expected. Other core whitefish items were volatile but less extreme.

Outlook: With volumes set to rebuild, cod should drift lower through year-end unless we see a repeat of last year’s late-summer counter-seasonal rally.

Past Reports

Commodities Report

Commodities Report

Commodities Report

Commodities Report

Menu Makers is a weekly tip series with the hottest and

most trendy menu items.

Click the play button on the left to watch the latest video,

or click the thumbnails below to review archived uploads.

Past Videos

Weekly Produce Reports

Weekly reports for all regions. Current conditions, market trends, historic projections, insider alerts – and all at your fingertips!

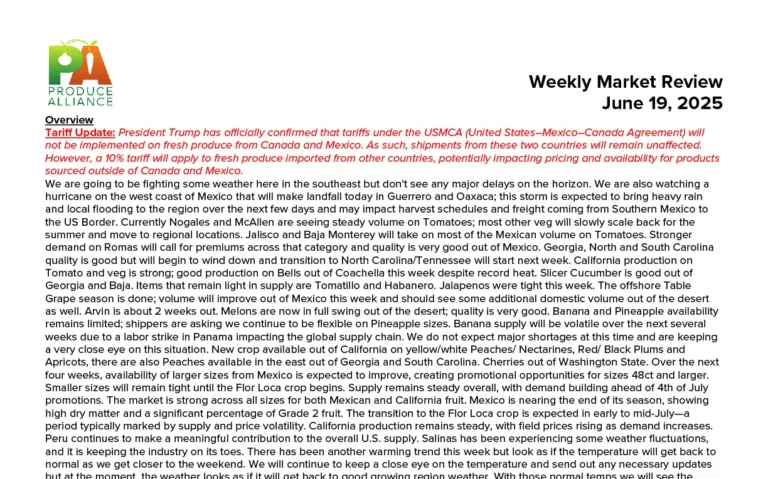

July 2, 2025 – We are going to be fighting some weather here in the Southeast but don’t see any major delays on the horizon. We are also watching a very active tropical pattern off the west coast of Mexico that will continue to bring cloudy weather, heavy rain and local flooding to the region over the …

Past Reports

Produce Alliance Market Report

Produce Alliance Market Report

Produce Alliance Market Report

Produce Alliance Market Report

Weekly Commodity Reports

Detailed Commodity Reports and video Hot Takes from ArrowStream, for those in need of more in-depth reporting.

CommodityONE Market Report

In search of more detailed insight? Look no further than ArrowStream’s multi-page weekly CommodityONE Report.

Click the thumbnail for the latest.

June 23, 2025 – In the protein markets, beef prices are on the rise, with cutout values showing a strong upward trend, reaching all-time highs. This surge is expected to continue, likely peaking after the July 4th holiday, even as cattle prices have seen a slight dip due to traders and speculators taking profits. Meanwhile, lean hog prices have surged and are forecast to remain …

CommodityONE Hot Takes

Paul Savage, Director of Commodities at ArrowStream, presents the latest CommodityONE Hot Takes.

Click the play button to watch the latest video,

or click the thumbnails below to review archived uploads.

Past CommodityONE Updates

Foodservice Operator News

Check out insights and tips produced by experts from the Buyers Edge Platform family of brands.

- All

- Articles

- Data / Technology

- Digital Procurement Network / GPO

- Fresh Solutions / Fresh Division

- Supply Chain

The Smarter Way to Cut Costs and Improve Efficiency Without Hiring More Employees

Source: Consolidated Concepts

How Automated Payroll Can Be a Game-Changer for Your Restaurant

Source: Back Office

Smart Operators Use Smart Tech: InsideTrack Delivers Results

Source: InsideTrack

A Clean Restaurant Is a Profitable Restaurant: Why Hygiene Drives Guest Loyalty

Source: Dining Alliance

The Power of Up-to-Date Supply Chain Data for Restaurant Chains

Source: ArrowStream

How Buyers Edge Platform Can Help Your Restaurant Stay Profitable

Source: Buyers Edge Platform

Ensure Restaurant Safety & Compliance Under the Human Foods Program

Source: Back Office

Stay up to date

The Latest Facts & Figures

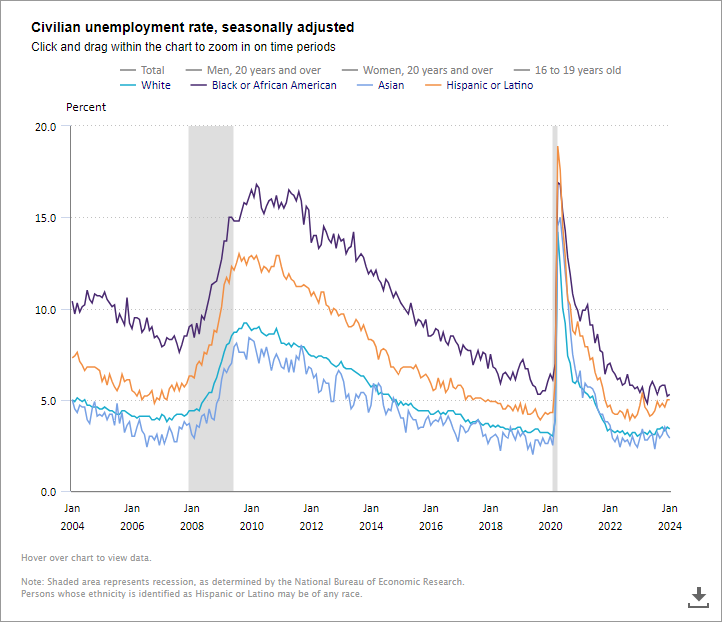

Live, interactive charts from industry experts

Monthly Economic Research From Our Partner:

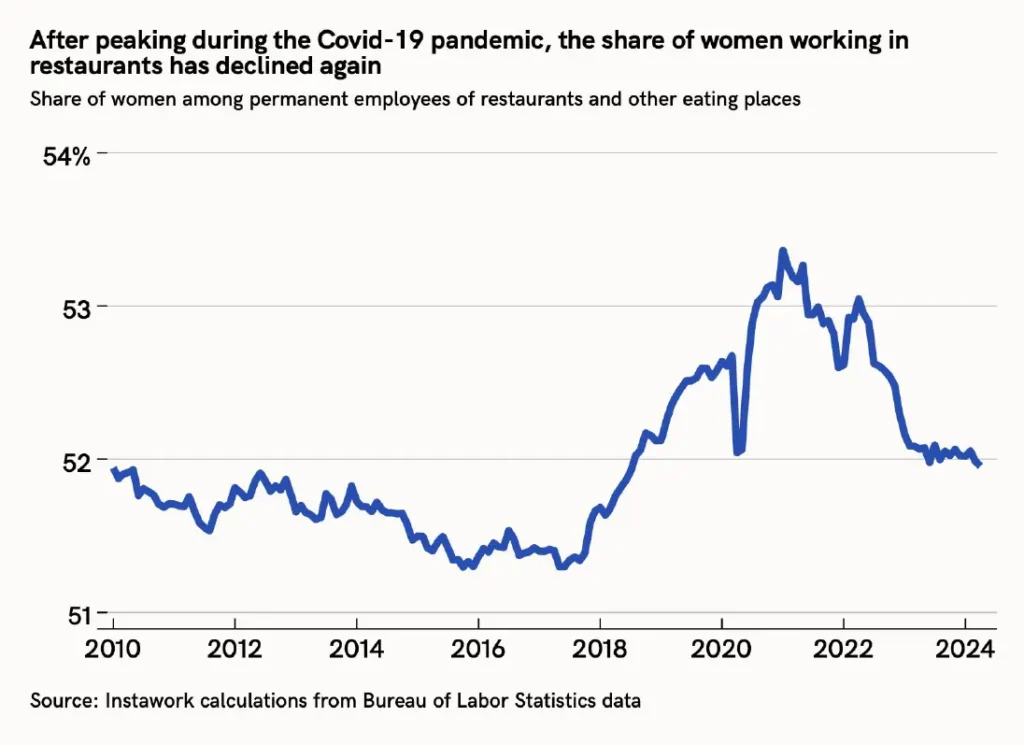

Why aren’t more women working in restaurants?

A shift to flexible schedules in the late 2010s allowed more women to work in restaurants, raising their share of employment in the industry. But since 2021, this share has dropped once again.

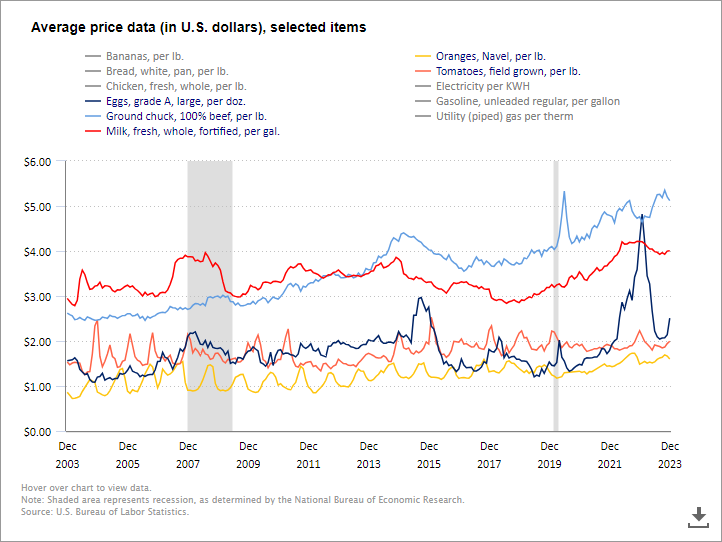

Click the thumbnails below to explore the latest data in each.

Then click the headings at the top to show or hide the different groups and categories.

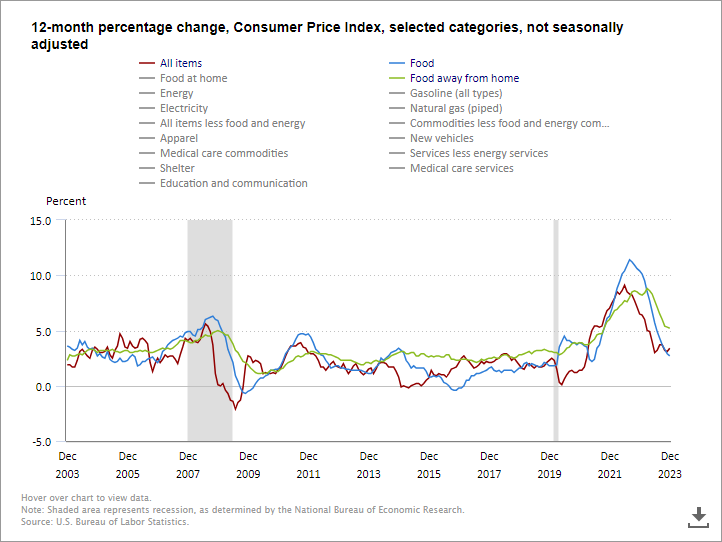

Consumer Price Index

Track the 12-month percentage changes of various goods and services.

Price Data

Track the price changes of key indicators including meat, produce and dairy.

Questions?

Contact our Team of Foodservice Experts

Submit this short form and an expert from the Buyers Edge Platform will reach back out to address your foodservice related questions or concerns.

Drop Us a Line

We will respond within 1-2 business days.