Foodservice Operator Support Center

Our Support Center has everything Operators need to remain connected. Weekly Commodity Reports, Supply Chain Hot Takes, and Produce Alerts – ready to review!

Commodities Snapshot Report

For the week of February 9, 2026

Quickly review the latest weekly snapshot on all major commodities!

And for a deeper dive, scroll to the CommodityONE Reports below.

-

Grains

Grain markets posted a positive week, led by the soybean complex. Optimism increased following trade announcements, including potential Chinese purchases of up to 8 million metric tons of U.S. soybeans, in addition to 12 million metric tons agreed to previously. Soybean oil prices reacted favorably, lifting the broader complex.

Outlook: If additional export demand is confirmed, soybeans could settle into a $10.80–$11.00 per bushel range, an improvement from recent levels. Until then, markets are expected to remain firm, supported by trade-related optimism.

-

Beef

Cattle markets were mixed, with the nearby CME February live cattle contract flat at $235.50/cwt. Boxed beef prices softened, with the Choice cutout down to $367.25/cwt and Select at $360.37/cwt. Strength persisted in premium cuts, including boneless heavy ribeyes, which rose $0.09 to $10.57/lb. End cuts were mixed, while ground beef 81% edged lower to $3.81/lb. Lower harvest volumes continued to support wholesale pricing.

Outlook: Despite February typically marking a seasonal demand low, sharply reduced harvest levels are keeping beef prices firm. Notably, 2.2 million pounds of Choice shortloins sold out front are expected to support higher pricing in the loin segment in the weeks ahead.

-

Dairy

Dairy markets were mixed. CME cheese blocks rose $0.09 to $1.47/lb, while barrels increased $0.03 to $1.44/lb, supported by strong retail demand. Butter prices surged $0.22 to $1.71/lb, though they remain $0.79/lb below the five-year average. Severe winter weather caused production disruptions and transportation challenges early in the week, impacting spot milk movement.

Outlook: Cheese pricing is expected to remain supported by steady production and retail demand. Butter markets may continue to see short-term volatility, but strong domestic demand should help stabilize prices as weather-related disruptions ease.

Click Show More to view Poultry, Pork and Seafood.

-

Poultry

Poultry markets moved higher last week as USDA young chicken harvest declined to 167.3 million head, down 3.3% week over week due to storm impacts in the Southeast. White meat prices led the gains, with boneless/skinless breasts rising $0.06 to $1.38/lb, now up 18% month over month. Wings climbed another $0.06 to $1.18/lb, making them 19% higher month over month, though still 39% lower year over year. Thigh meat continued to strengthen, with boneless/skinless thighs up 16% m/m and 7% y/y. In eggs, the USDA large eggshell index surged nearly 46% w/w, but remains 82% lower year over year.

Outlook: With harvest volumes constrained and weather disruptions lingering, poultry prices are expected to trend steady to slightly higher in the near term. While gains have slowed, supply-side pressure should continue to support pricing—particularly for wings and white meat cuts.

-

Pork

Pork markets posted gains last week, with the carcass cutout up 2% to $95.27/cwt as harvest volumes declined. Pork butts were a key driver, with the butt primal up 4% to $114.88/cwt, and boneless butts climbing to $1.45/lb. Bellies also strengthened, rising 4% to $131.88/cwt, while ribs moved lower, with the rib primal down 6% w/w. Export demand remained steady, with 157 loads of boneless pork butts sold internationally.

Outlook: With lower harvest volumes and freezer inventory rebuilding, pork prices are expected to trend steady to slightly firmer. While retail demand remains soft, supply dynamics should continue to support the cutout and lean hog markets.

-

Seafood

Seafood markets saw continued strength in snow crab pricing. Frozen snow crab prices climbed 15.9% month over month, following a 7.1% increase in October, reaching a new three-year high of $10.69/lb. The rally erased losses from much of the past year and extended a longer-term uptrend.

Outlook: Snow crab prices are expected to remain elevated into early 2026, consistent with seasonal trends. Some price relief may emerge by summer, but operators should plan for continued near-term pressure on crab items.

Past Reports

Commodities Report

Commodities Report

Commodities Report

Commodities Report

Menu Makers is a weekly tip series with the hottest and

most trendy menu items.

Click the play button on the left to watch the latest video,

or click the thumbnails below to review archived uploads.

Past Videos

Weekly Produce Reports

Weekly reports for all regions. Current conditions, market trends, historic projections, insider alerts – and all at your fingertips!

February 12, 2026 – Tight market conditions continue across the vegetable category. Cool weather in Mexico and last week’s freeze in Florida are impacting tomatoes, cucumbers, squash, beans, bell peppers, and corn. Supply chain challenges—including limited equipment, driver delays, and overall …

Past Reports

Produce Alliance Market Report

Produce Alliance Market Report

Produce Alliance Market Report

Produce Alliance Market Report

Weekly Commodity Reports

Detailed Commodity Reports and video Hot Takes from ArrowStream, for those in need of more in-depth reporting.

CommodityONE Market Report

In search of more detailed insight? Look no further than ArrowStream’s multi-page weekly CommodityONE Report.

Complete and submit the following form to receive your full report.

CommodityONE Hot Takes

Paul Savage, Director of Commodities at ArrowStream, presents the latest CommodityONE Hot Takes.

Click the play button to watch the latest video,

or click the thumbnails below to review archived uploads.

Past CommodityONE Updates

Step inside the foodservice world with Grounded, where we sit down with industry leaders to explore their personal journeys, business challenges, and big-picture perspectives from sourcing to service.

Hit play to watch the latest episode, or browse past conversations using the thumbnails below.

Foodservice Operator News

Check out insights and tips produced by experts from the Buyers Edge Platform family of brands.

- All

- Articles

- Data / Technology

- Digital Procurement Network / GPO

- Fresh Solutions / Fresh Division

- Supply Chain

How to Manage Labor Cost in the Restaurant Industry

Source: InsideTrack

How Restaurant Rebates Work and Why They Matter for Growing Restaurant Brands

Source: Consolidated Concepts

Restaurant Supply Chain Management: A Comprehensive Guide

Source: Buyers Edge Platform

Food Service Contracts: What Restaurants Should Look For

Source: InsideTrack

Biggest Hospitality Industry Challenges and How to Solve Them

Source: Buyers Edge Platform

Restaurant Inflation: Why Costs Keep Rising & What Owners Can Do

Source: InsideTrack

Restaurant Equipment Checklist: Everything You Need to Know

Source: Dining Alliance

Stay up to date

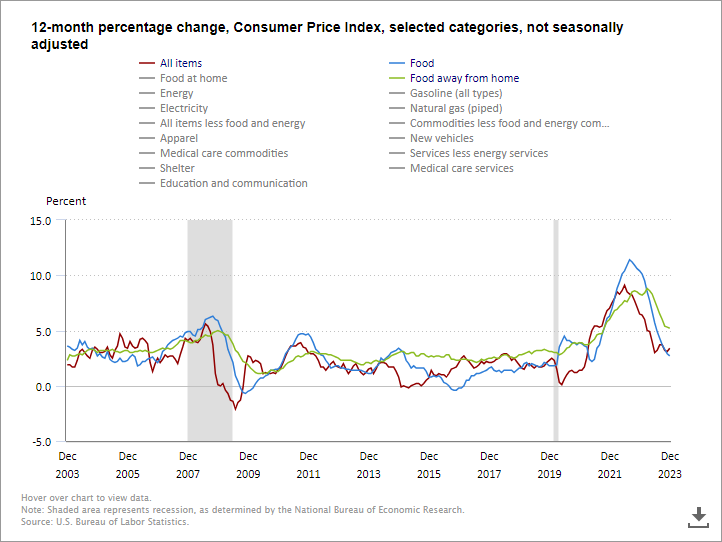

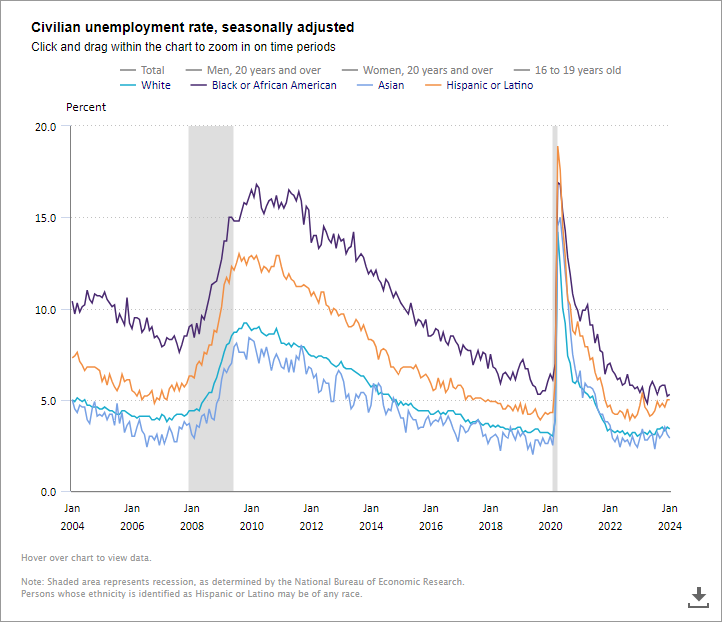

The Latest Facts & Figures

Live, interactive charts from industry experts

Click the thumbnails below to explore the latest data in each.

Then click the headings at the top to show or hide the different groups and categories.

Consumer Price Index

Track the 12-month percentage changes of various goods and services.

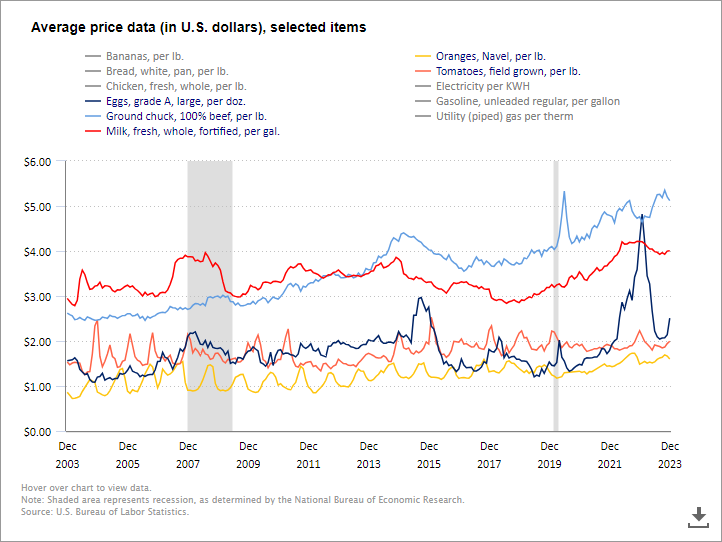

Price Data

Track the price changes of key indicators including meat, produce and dairy.

Questions?

Contact our Team of Foodservice Experts

Submit this short form and an expert from the Buyers Edge Platform will reach back out to address your foodservice related questions or concerns.

Drop Us a Line

We will respond within 1-2 business days.