Supply Chain Support Center

Concerns over the Supply Chain? We’ve got your back!

Supply Chain Support Center

Updated Weekly

The best place for you every week to stay up to date on all things supply chain – from news, tips, insights, videos, recommendations, and much more!

Concerns over the Supply Chain? We’ve got your back!

Many of our operators have expressed concerns and struggles around the strained supply chain. At Buyers Edge Platform, our greatest asset is our clients and members.

That’s why we’ve teamed up with our family of brands to bring you our Supply Chain Support Center. This center will be the best place for you every week to stay up to date on all things supply chain – from news, tips, insights, videos, recommendations, and much more!

Market Alerts & Produce Updates

For the Week of October 31, 2022

The following updates and alerts were culled in collaboration with our growing family of brands. Scroll through both lists to help prepare for upcoming obstacles and opportunities.

Market Alerts

-

Grains

Canola moved sideways as the crop is nearly 100% complete. The crop looks good but inconsistent across different growing regions. -

Dairy

Prices for shell eggs are rising once more as demand rises and supplies become more scarce. Butter prices are stable as the conclusion of the holiday shopping season draws closer. The supply situation for blocks of cheese is good, and there is some pressure in the barrel market. -

Beef

The market can be best defined as unsettled as a result of the harvest number being higher than anticipated last week and packers’ pricing trajectory rising. Ribs continue to command higher prices, with premium grade packaging and light weight range products. Strip production is still strong, but in the coming months, there won’t be as many premium boxes available for purchase. The grind is constant. -

Pork

The market for butts is expected to rise as a result of increased demand from merchants, which is expected to continue steady for the coming week. In line with seasonal trends, the market for boneless loins remains soft. Due to suppliers clearing out their cold storage stocks, the price of ribs is still declining. After the recent increase, the enthusiasm for bellies has calmed off. Ham levels remain high. -

Poultry

Although it is wing season, there are still plenty of wings available. Prices are falling quickly and there are more tenders available. Breasts of every size are widely accessible, and costs are dropping. Prices for boneless thigh meat decreased once more this week. Boneless leg meat prices keep dropping. Cut-ups and whole birds had greater prices. -

Seafood

Due to conservation concerns, the Alaska Department of Fish and Game announced the closure of the Alaskan Red King crab season and the Alaskan snow crab season for 2022–2023. As processors find new labor sources, catfish production keeps becoming better. In Texas and Louisiana, landings of head-on shrimp for peeling have significantly decreased.

Produce Updates

- Persistent weather issues, hurricanes, and commodity transitions have contributed to prolonged volatile markets across many commodities, which are likely to remain through November.

-

Asparagus

Mexican production continues to be low due to recent weather in the growing areas. Peruvian production has increased this week. This trend should continue through November. Markets are still very active with no change in volume from Mexico. -

Bananas

Volume is lighter this week due to weather impacts, higher global demand and lighter production. We are seeing no quality issues at this time. -

Beans, Green

Extremely limited supply available out of South Georgia. There are a few beans out west, but markets remain very high and expected to be snug through the Thanksgiving Holiday. -

Blackberries

Supplies are increasing from Mexico and quality is good. Watsonville is decreasing and will be done in the next few weeks. Volumes are expected to hit peak production by early December. -

Broccoli

Current supply continue to be lighter; market remains active. -

Cabbage, Red

Supplies are increasing, and quality is improving. -

Cantaloupe

There are limited supplies of cantaloupe in Arizona this fall which is shaping up to become even shorter as many growers are projected to finish earlier than anticipated. Current sizing in Arizona has been providing mostly all larger fruit with 9/9Js being predominant with 12s being extremely limited. -

Cauliflower

Supplies have gotten extremely short from the cooler weather, and the market has increased significantly. Expect light supplies to continue at least through next week. -

Cilantro

Supply is going to continue to be light, but improving, as yields continue to be light due to the recent heat and adverse weather in all growing areas. -

Cucumber

Markets remain firm as volume is lighter out of Baja and South Georgia this week. Lighter supply crossing through Nogales and Texas as well, but we hope to see improvement over the next 10 days. -

Lemons

New Crop Lemons have begun in District 3 and District 1. Current supply is peaking on 115/140/165 with an even balance of Fancy & Choice, and some Standard Grade. Field and Packinghouse QC is seeing some wind scaring in the Choice/Standard grade. Fancy looks nice! Volume & Availability is light due to fruit readiness and more fruit will be available each week. -

Limes

Crossings are improving, and coloring and overall shelf life has begun to improve upon introduction of the new crop. Conditional defects in the form of styler end breakdown and oil spots continue to impact the fruit due to recent inclement weather and will continue to be representative given last week’s rain events. The crop is currently peaking on small fruit; mid-sized fruit yields are increasing; large sizes (esp. 110’s) remain limited. -

Mushrooms

Quality is good despite supply being lighter than expected. We continue to see lack of labor, shortages in component of growing such as peat moss and other inflationary pressures. We expect to see this continue to be a challenge until some of the growing costs can get under control of this particularly labor intensive and cost sensitive item. -

Onions, Green

Market is slightly lower, although supplies continue to be very short. -

Onions, Red/Yellow

The market continues to have a ‘softer’ feel overall. Demand has been sluggish out of all regions – in large part due to change of season/weather, and some growing concerns regarding the economy. Growers are beginning to finish up harvest, which is earlier than normal. -

Peppers, Green

Supply is lighter this week and overall quality has been good out of South Georgia. Northern California is mostly done for the season, and we are transitioning to the desert this week. Quality in the west is very nice. -

Peppers, Red

Markets are holding strong as supply remains limited this week. We are scratching this week in the desert and quality is very nice. -

Raspberries

Supplies are increasing from Mexico and should be in peak production by next week. Mexico will be in peak season for 7-10 days before down-trending for the remainder of the year. The current quality is good. Watsonville is decreasing and will be done by end of the month. -

Squash, Yellow/Zucchini

Markets were mixed this week as supply tightened up in South Georgia and local deals wrapped up for the season. Steady numbers crossing through Nogales this week.

Produce Alliance Market Alert

October 31, 2022 – We want to make sure we keep you informed of another Tropical Storm moving through the Western Caribbean which could impact Guatemala and parts of Southern Mexico. We are primarily concerned over French Bean production for Thanksgiving as well as Melon and Banana production in the region.

Thank you for your patience and understanding at this time. We are working closely with our grower/partners and will update once we have any additional information.

Comments or Questions?

Schedule a meeting to connect directly with a Supply Chain Expert from the Buyers Edge Team.

Supply Chain News and Insights

The Buyers Edge Platform has been busy putting together all of the insights you need around the strained supply chain. Sign up for one of our upcoming webinars, read some expert insight, or check out our collection of Market Report blogs below!

- All

- Articles

- Commodities Report

- Data / Technology

- Digital Procurement Network / GPO

- Expert Insight

- Fresh Solutions / Fresh Division

- Hot Takes

- Market Reports

- Menu Makers

- Podcasts/Webinars

- Supply Chain

- Technology

- Uncategorized

Commodities Report

Alerts & What’s Trending Produce Avocado prices surprised to the downside, falling 18 % to a YTD low and ...

Commodities Report

Alerts & What’s Trending Produce Avocado prices ended their 11-week slide with a minor uptick. Roma tomatoes dropped another ...

52 Ways to Unlock Foodservice Value with Buyers Edge Platform

Rising costs, labor issues, and changing expectations are putting more pressure on operators to do more with less. That’s why ...

Stay up to date

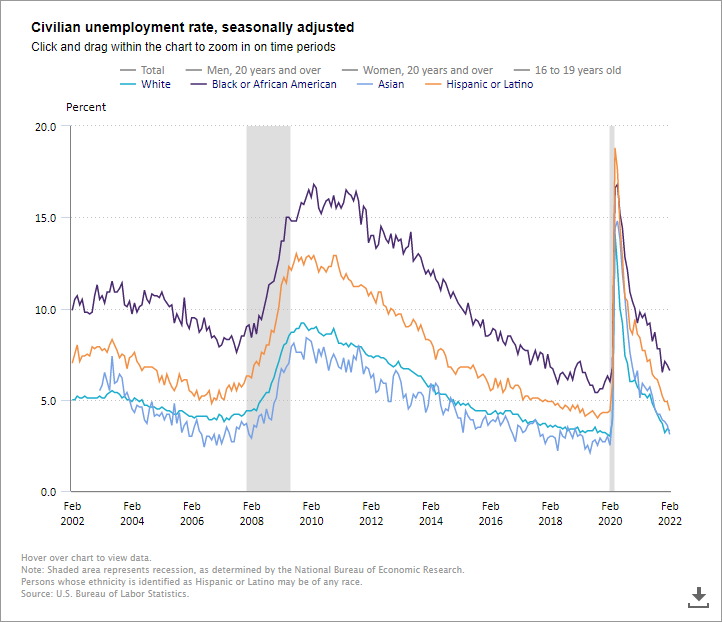

The Latest Facts & Figures

Live, interactive charts from U.S. Bureau of Labor Statistics.

Click the headings at the top to show or hide the different groups and categories.

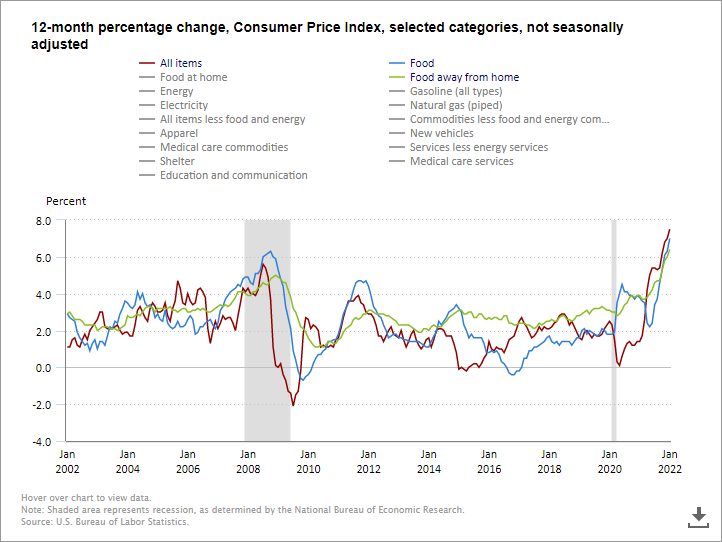

Consumer Price Index

Track the 12-month percentage changes of various goods and services.

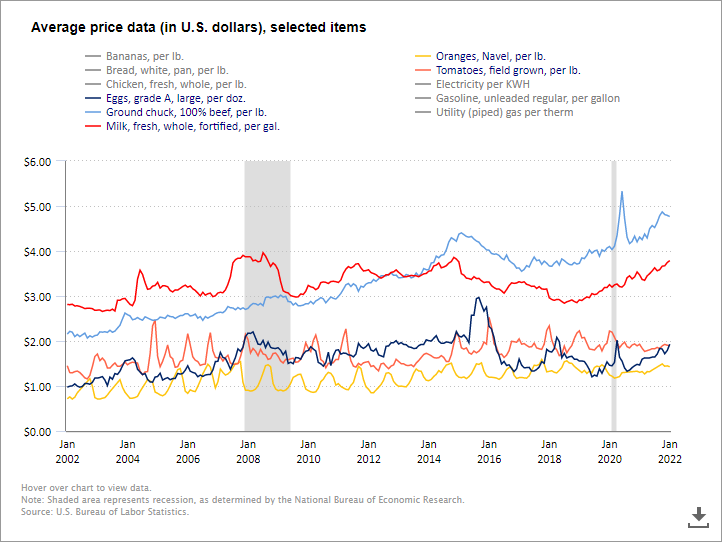

Price Data

Track the price changes of key indicators including meat, produce and dairy.

Questions?

Contact our Team of Supply Chain Experts

Submit this short form and an expert from the Buyers Edge Platform will reach back out to address your supply chain related questions or concerns.

Drop Us a Line

We will respond within 1-2 business days.