Supply Chain Support Center

Concerns over the Supply Chain? We’ve got your back!

Foodservice Operator Support Center

For the week of April 1, 2024

The following updates and alerts were culled in collaboration with our growing family of brands. Scroll through both lists to help prepare for upcoming obstacles and opportunities.

Commodities

The latest report is on the left.

Links to past reports are on the right.

-

Grain

Last week, soybean oil saw another increase as fund traders resumed purchasing contracts rather than disposing of them. This week's plating intentions report is expected, and some acres are predicted to shift from corn to soybeans. In Europe, palm stabilized with a short-term balance, while canola rose upward with fewer planted acres. -

Dairy

Despite a decrease in the total amount of shell eggs in stock, all shell egg markets are rising. The markets in California and the Northwest are stagnant, but with Easter, they might rise. Based on export, the Block decreases and the Barrel is increases. Although butter doesn't rise, it can due to variations in milk production and the demand for cream. -

Beef

The supply and demand are still matching. While strips and tenders continue to rise because to increased demand and limited supply, ribs remain stable. Chuck should make corrections in the following weeks, but it looks like end cuts have reached a ceiling as insides. In the short run, thin meats and grinds are experiencing the most artificial assistance due to restricted harvest. -

Pork

The butts of B/I are rising. Since there has been some downturn in the boneless industry, boneless butt sales are declining. The market for ribs is predicted to continue rising since supply is anticipated to become more limited throughout the warmer months. As retail demand for loins rises, loin prices are also rising. Bellies continue to go down. -

Poultry

Bird mortality, hatchability, and weights are limiting product availability and driving up costs. There is a high demand and limited supply for breasts. It's still difficult to find wings in the market. There is a high demand for tenders and no excess supply. The desire for dark meat is still high. Whole birds, still mostly balanced. -

Seafood

The Pacific Halibut season has begun, and while whole fish prices are now higher, it is anticipated that they will decrease over the next few weeks. The supply of lobster in the North Atlantic is still decreasing, and prices are rising. Due to increased supply, warm water lobster prices have remained stable and have not grown as anticipated.

-

Report for March 25, 2024

Poultry

Bird mortality, hatchability, and weights are limiting product availability and driving up costs. There is a high demand and limited supply for breasts. It's still difficult to find wings in the market. There is a high demand for tenders and no excess... -

Report for March 18, 2024

Dairy

Despite a decrease in the total amount of shell eggs in stock, all shell egg markets are rising. The markets in California and the Northwest are stagnant, but with Easter, they might rise. Based on export, the Block decreases and the Barrel is...

Produce

The latest report is on the left.

Links to past reports are on the right.

- Continued adverse weather conditions across various growing regions have caused a considerable drop in overall yields and an uptick in quality problems and bloom loss. Thankfully, several regions are expected to experience better weather in the upcoming weeks, which will likely improve the situation in multiple markets. We are less than a month away from the beginning of the leafy green transition, heading back to the Salinas Valley. Historically, we have seen higher markets and increased quality issues during this time. The weather has taken its toll on most commodities in Yuma, and the market has risen considerably.

-

Artichokes

Supplies and production are in full swing. Sizing is still running heavy to larger sizes and quality is good although we continue to see frost damage due to recent cold weather. -

Asparagus

Asparagus production continues to improve in all regions in Mexico. Peruvian production is finished due to seasonality. Markets continue to be less active with the increased production from Mexico. -

Avocado

Last week's harvest closed at 59M pounds, a 22% volume increase over the previous week. Last week was only the 2nd time this year the harvest exceeded projections. The size curve coming off the trees continues to be fairly equal on 48s and 60s. The crop continues to mature, and dry matter averages 32%. California harvest of the 2024 season has begun in a small way, and impactful volumes are expected in late March or early April. -

Bananas

Steady volume expected through Q1 and Quality to be good. -

Beans, Green

Markets were mixed this week; fair volume and light demand out of Florida are putting downward pressure on pricing. Volume is still lighter in the west crossing through Nogales and overall quality is mixed. We may see lighter volume in Nogales this week with rain in the forecast. -

Blueberries

Quality is good out of Chile and Mexico; cool morning temps are preventing soft fruit. The fruit is a good size with good bloom and only occasional ripped calyx. -

Broccoli

We are seeing good quality with steady volume on both crowns and bunch. Market is steady with good demand, but we could see a slight increase in the market next week. -

Brussels Sprouts

Supplies and quality remain good as Mexico and the Oxnard growing regions are in full production, market is steady. -

Cabbage, Red

Quality is good although supplies continue lighter. Market is steady. -

Carrots

We have seen a slight increase in supplies with very good quality now that the Desert season has gotten started. Market is still active, but some pricing is trending down. -

Cauliflower

We are seeing light supplies, and we expect this to continue for the next few weeks, Market is considerably stronger, reflecting higher FOBs with strong demand. Quality is very nice despite the current market and supply situation. -

Celery

Some harvesting has been delayed in the Oxnard growing region although steady supplies continue with good quality. -

Corn

Lighter supply continues due to the cold weather and lack of sun in Florida this season. In the west, Nogales is dealing with the same issues resulting in a very light supply. Markets are mid to upper 30's FOB for fair quality and we do not expect any improvement for the next few weeks. -

Cucumber

Limited volume available out of Mexico crossing through McAllen and Nogales. Honduran import volume was short as well loading in Miami. Overall Quality is fair. We recommend subbing to English Cucumbers if necessary. -

Grapes, Green/Red

Vessel delays are impacting the ports, and we are seeing extremely light supply for market and contract business. We expect this to continue through the month with elevated pricing on market business. We are seeking subs on green, reds and black grapes in some circumstances to cover program business. Overall quality is good, and we expect volatile markets until the logistics issues are resolved. -

Herbs

Fresh herbs remain steady this week, but we are looking at potentially having some quality issues in the upcoming weeks. The quality took a little hit from the cold and rain. Dill, thyme, and oregano will turn purple due to the cold, and some locations have this issue. Although the herbs are fine to cook with, their appearance will throw you off. -

Lemons

More rain is forecasted in the lemon growing regions of central California starting Sunday, which will lead to a delays in harvesting. In addition, we will be seeing a significant decrease in small size lemons and an increase in large sizes so please plan accordingly and be sure all orders are placed in advance. -

Lettuce, Boston/Butter/Green/Red Leaf

Supplies have decreased with the reduced yields from recent weather. The market is trending much higher than usual and will continue into next week. Expect markets to continue active for the next several weeks. Due to freezing temperatures and rain episodes, lettuce will exhibit various degrees of blister, peel, and weather-related issues. -

Limes

Crossings from Mexico continue light with steady demand. Market continues strong and all sizes are escalated. -

Mushrooms

Stable supply and good quality available. -

Onions, Green

We continue to see the effects of the previous weather patterns on green onions as supplies remain limited. The market continues to remain at high levels that will continue into next week. -

Peppers, Green

Very tight supply this week out of Florida while supply is slowly improving out of Mexico. Quality is good. -

Peppers, Red

Very light supply crossing through Nogales and McAllen this week. We are seeing maturity issues and lack of color mostly due to cooler weather over the past ten days and yellow seems to be the shortest and will see the need to sub. We hope to see this improve over the next two weeks. -

Potatoes, Russet

The market continues to feel stable on all sizes and grades for the moment, with the exception of 40ct potatoes. While potatoes as a whole should remain plentiful, we do anticipate 40ct commanding a premium more often than not until the end of the crop. They have continued to be available for mixers, but we are not seeing very much straight load availability, or even availability in heavy volume. There will be some lots that are better than others throughout the season, but this does appear to be a theme moving forward. Because of this, we do anticipate that we may see a pretty big gap between 40ct/50ct and the rest of the sizes. The good news is that food service sized cartons in the middle size range (60/70/80) appear to be plentiful. -

Raspberry

Quality is good with even color, firmness and, continue to see occasional crumble. Supplies are somewhat steady. -

Spinach

Lighter supplies continue, with some harvesting being delayed due to the rain last week. Due to recent cold weather and significant rain in the desert growing regions of Southern California and Western Arizona (Yuma), Arugula and other tender-leaf vegetables have been affected by tip burn, yellowing, and occasional discoloration. Shippers continue to report lighter supplies and are prorating orders. -

Squash, Yellow/Zucchini

Shipping out of Florida, McAllen and Nogales and quality is fair. We expect to see pro-rates this week due to cool weather and very light supply. Markets are expected to improve over the next two weeks with Zucchini already showing signs of improvement which will cause a huge variance in availability between green and yellow squash. -

Strawberries

Strawberry supplies are expected to remain lower for the next 3-5 due to weather conditions. California production remains low due to continued rainfall. The quality remains lower with some white shoulders. There is some rain forecast for Monday and possibly Saturday this coming week, but fields should dry out over the weekend. Mexico volumes are slowly decreasing as they are past peak season. Overall, the quality is good, with some white shoulders. Florida supplies are somewhat steady due to scattered rainfall in the growing region. -

Tomatoes, Cherry/Grape

We expect to see very short crops, escalated pricing, and potential for pro-rates continue through March. Ongoing rain and cool weather continue to delay the crop. Until we see some return to warm weather and less rainfall, a crop recovery will not materialize. Crops out of Mexico are slowly improving, and we are seeing a downward trend on price as the volume increases. Unfortunately, with the imbalance on the East Coast due to less acreage planted and weather-related pressure, markets remain at record highs. We will see this continue until Florida can produce volume consistently. -

Tomatoes, Loose/Vine Ripe

Markets have turned for the worse with very limited supply and ongoing delays due to the weather; several days of cold, cloudy, and rainy weather have delayed the crop. We hope to see this improve over the next two weeks and may see some pro-rates; therefore, we recommend shifting to romas when necessary due to lack of quality, supply, and price. -

Tomatoes, Roma

Stable supply and good quality available.

-

Report for March 25, 2024

Continued adverse weather conditions across various growing regions have caused a considerable drop in overall yields and an uptick in quality problems and bloom loss. Thankfully, several regions are expected to experience better...

-

Report for March 18, 2024

We are less than a month away from the beginning of the leafy green transition, heading back to the Salinas Valley. Historically, we have seen higher markets and increased quality issues during this time. The weather has taken its toll on...

California Weather Alert

December 13, 2022 – The West Coast and San Joaquin Valley of California, has been receiving rainfall over the last few days, impacting all growing areas including Salinas, Santa Maria, Oxnard, into southern California and the Central Valley.

As a result, this has caused delays as fields are too muddy to harvest. Unfortunately, there has not been enough rain to reverse the major drought conditions they continue to experiencing, but is enough to affect harvesting for a few days.

Comments or Questions?

Schedule a meeting to connect directly with a Supply Chain Expert from the Buyers Edge Team.

Foodservice and Supply Chain News

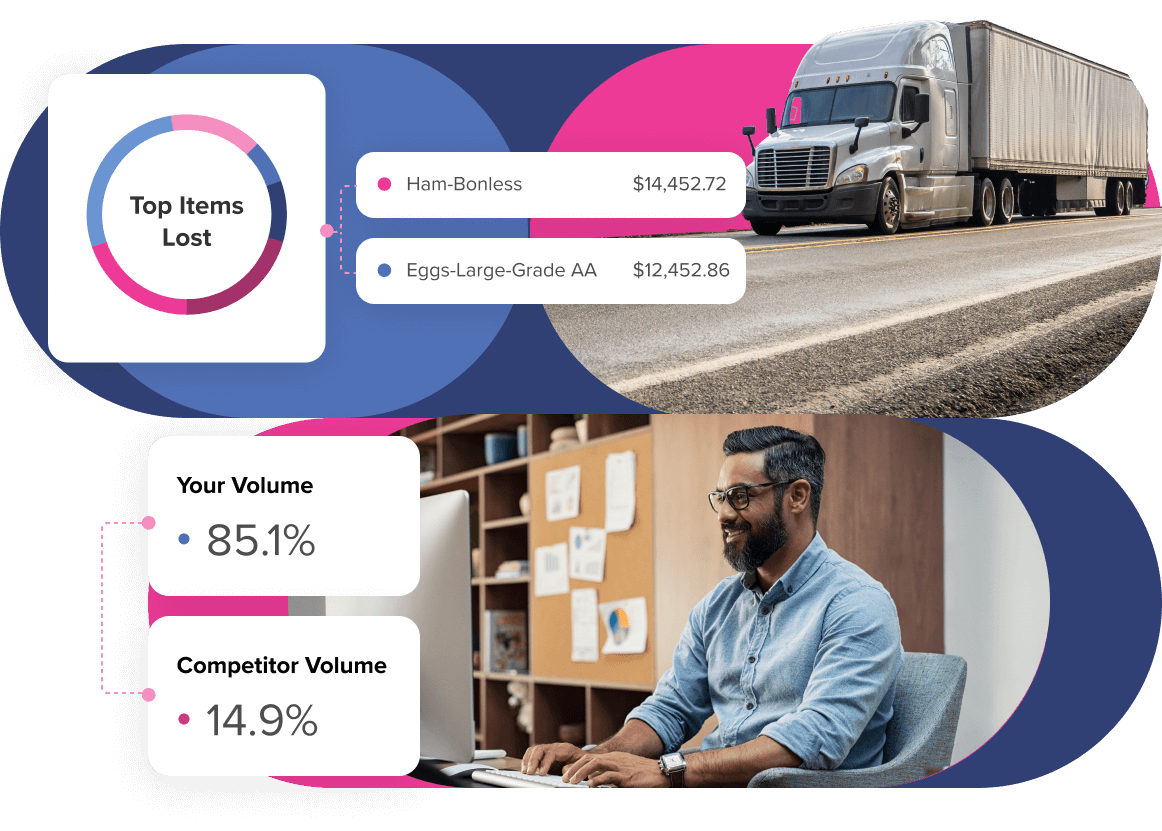

The Buyers Edge Platform has been busy putting together all of the insights you need regarding the industry’s fluctuating supply chain.

If necessary, choose Articles or Market Reports to filter your list.

- All

- Articles

- Commodities Report

- Data / Technology

- Digital Procurement Network / GPO

- Fresh Solutions / Fresh Division

- Grounded

- Insights

- Market Reports

- Menu Makers

- Supply Chain

- Supply Chain Management

Commodities Report

Alerts & What’s Trending Produce Tomatoes and lettuce led produce volatility, with 25 lb. romas holding above $15/carton amid ...

Commodities Report

Alerts & What’s Trending Produce Lettuce prices continued climbing, with iceberg nearing historically rare levels above $50/carton. Tomato markets ...

Commodities Report

Alerts & What’s Trending Produce Produce markets continued to tighten, led by lettuce and tomatoes. Iceberg lettuce prices surged ...

Restaurant Supply Chain Management: A Comprehensive Guide

If you work in restaurants long enough, you learn one thing pretty quickly: when the supply chain is off, everything feels harder. Prep ...

Stay up to date

CommodityONE Hot Takes

Paul Savage, Director of Commodities at ArrowStream, presents the latest CommodityONE Hot Takes.

Click the play button to watch the latest video,

or click the thumbnails below to review recent uploads.

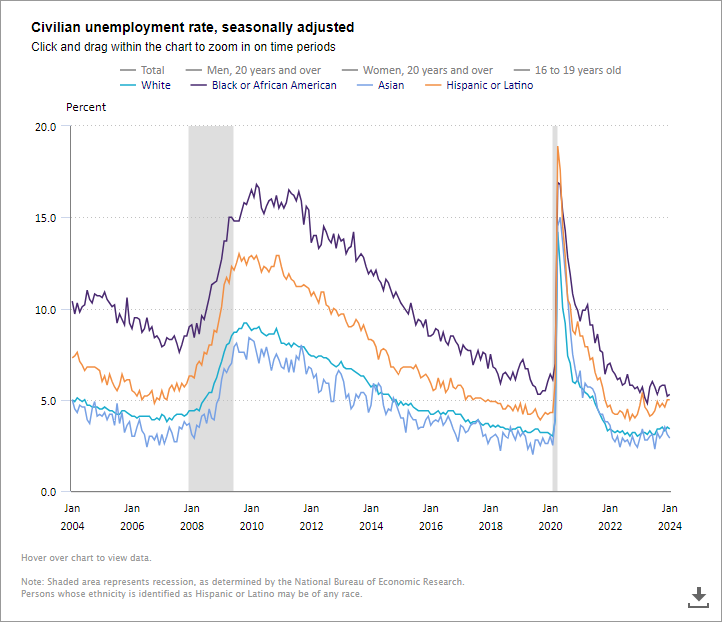

The Latest Facts & Figures

Live, interactive charts from industry experts

Click the headings at the top to show or hide the different groups and categories.

Monthly Economic Research From Our Partner:

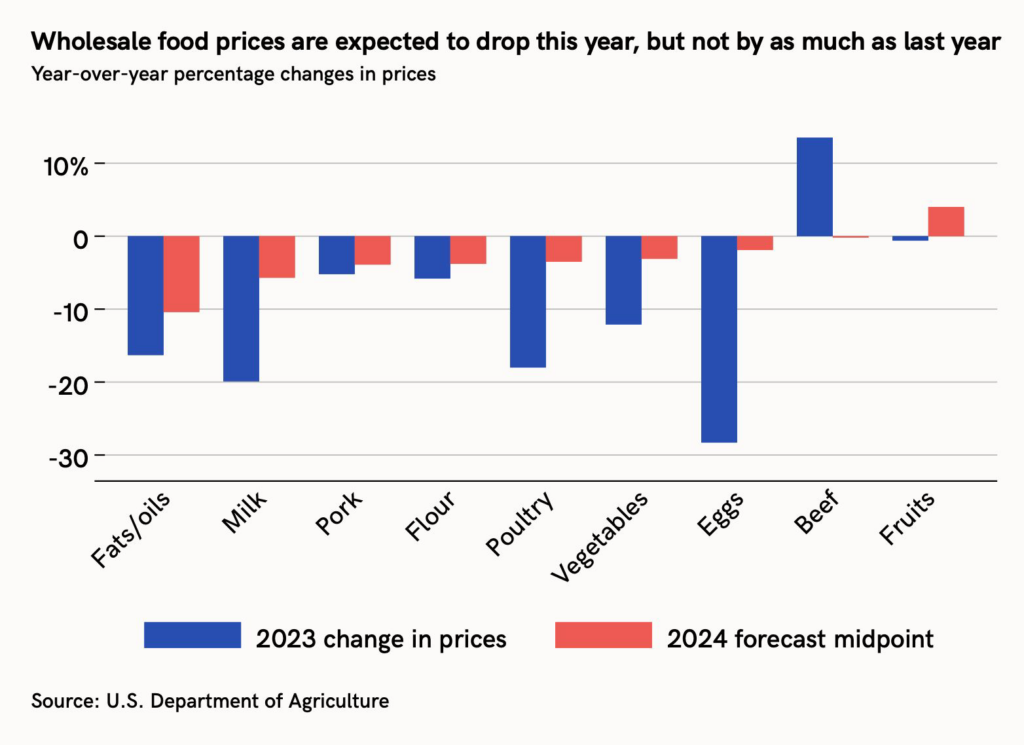

Food prices are finally stabilizing

After a roller-coaster ride in the past two years, food prices are expected to move much less in 2024, with lower prices in most wholesale categories. Could underlying fuel costs still be a wild card?

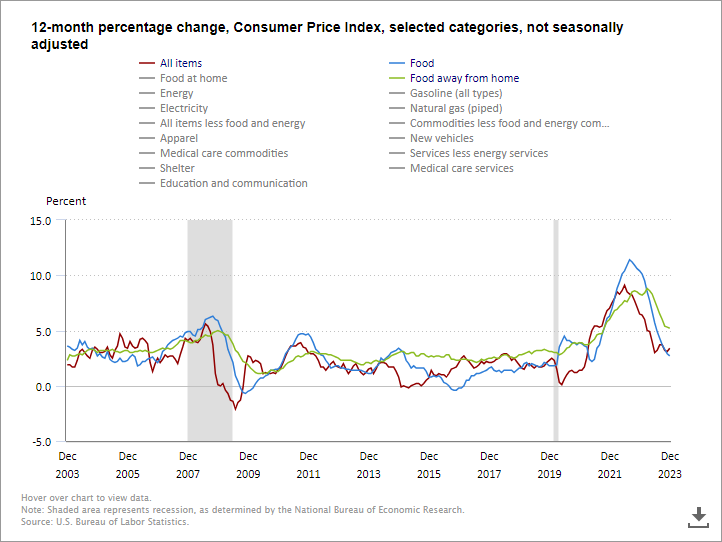

Consumer Price Index

Track the 12-month percentage changes of various goods and services.

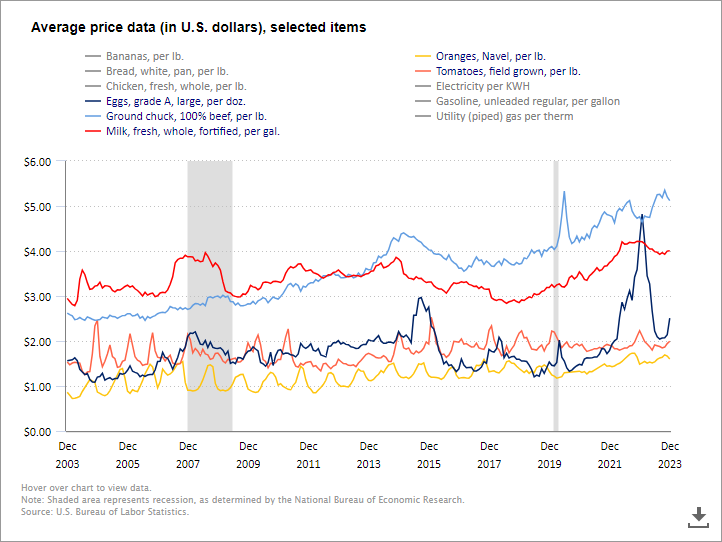

Price Data

Track the price changes of key indicators including meat, produce and dairy.

Questions?

Contact our Team of Supply Chain Experts

Submit this short form and an expert from the Buyers Edge Platform will reach back out to address your supply chain related questions or concerns.

Drop Us a Line

We will respond within 1-2 business days.