Foodservice Operator Support Center

Our Support Center has everything Operators need to remain connected. Weekly Commodity Reports, Supply Chain Hot Takes, and Produce Alerts – ready to review!

Commodities Snapshot Report

For the week of April 7, 2024

Quickly review the latest weekly snapshot on all major commodities!

And for a deeper dive, scroll to the CommodityONE Reports below.

This week’s snapshot report is taking a brief pause.

Fresh insights will be back next week—stay tuned.

-

Grain

Corn and wheat held mostly flat thanks to early-week gains from USDA reports, but new tariff fears sparked a market-wide sell-off later in the week. Mexico was spared, keeping corn more stable, but tensions with major buyers like China and Japan could pressure prices going forward. Soybeans remain the weakest link due to lack of bullish fundamentals.

-

Beef

Despite a dip in cattle futures, beef prices remain firm across premium cuts. Ribeyes and tenderloins surged again, with tenderloins up 6% to $14.55/lb. Ground beef and trim also climbed, suggesting strong seasonal demand. Chuck and round segments were more mixed. As grilling season heats up, beef is expected to retain price strength on the back of strong fundamentals.

-

Dairy

Butter and cheese prices ticked slightly lower amid softening foodservice demand and fewer retail promos. Cheese blocks dropped to $1.62/lb, while barrels nudged up. Butter fell $0.05 to $2.33/lb. Milk output is increasing, inventories are growing, and the market remains steady with balanced demand.

Click Show More to view Poultry, Pork and Seafood.

-

Poultry

Chicken breast prices surged again—now at $2.41/lb, up 57% year-over-year—while boneless thighs also rose to $1.76/lb. WOGs and foodservice bird sizes posted moderate gains, and after weeks of falling, wings finally saw a tiny uptick. Egg prices continue to slide, down another 3% w/w and over 50% m/m, as imports help stabilize supply ahead of Easter. Looking ahead, tariff-related uncertainty and flat demand may put downward pressure on wholesale chicken prices.

-

Pork

Pork markets held steady with the cutout flat at $94.81/cwt. Loins and butts posted modest gains, while tenderloins and ribs softened. Belly prices continued to fall, now down 6% w/w. Export volumes rose, but ongoing tariffs from Mexico and China cast uncertainty. Volatility is expected, but domestic consumers could benefit from softening prices.

-

Seafood

Frozen snow crab surged 33% m/m in February to $10.24/lb—its highest since mid-2022—driven by tight imports. But this momentum likely won’t last, as demand and volume typically increase by late May and peak in summer. Relief isn’t expected until August.

Past Reports

Commodities Report

Commodities Report

Commodities Report

Commodities Report

Menu Makers is a weekly tip series with the hottest and

most trendy menu items.

Click the play button on the left to watch the latest video,

or click the thumbnails below to review archived uploads.

Past Videos

Weekly Produce Reports

Weekly reports for all regions. Current conditions, market trends, historic projections, insider alerts – and all at your fingertips!

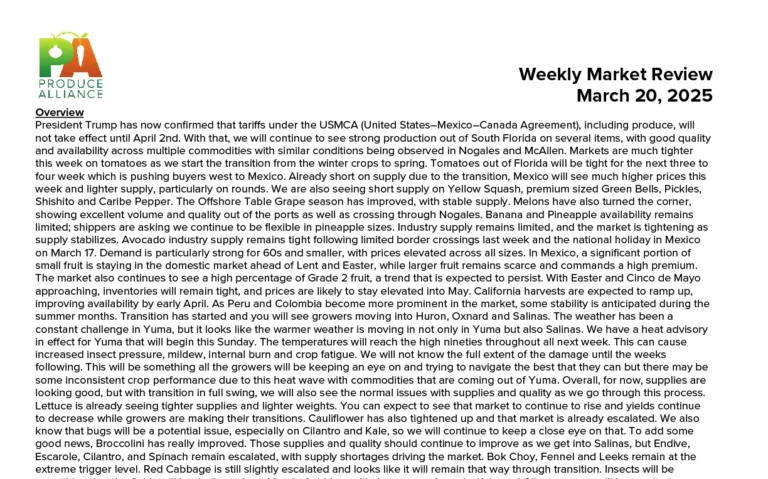

April 17, 2025 – Tariff Update: President Trump has officially confirmed that tariffs under the USMCA (United States–Mexico–Canada Agreement) will not be implemented on fresh produce from Canada and Mexico. As such, shipments from these two countries will remain unaffected. However, a 10% …

Past Reports

Produce Alliance Market Report

Produce Alliance Market Report

Produce Alliance Market Report

Produce Alliance Market Report

Weekly Commodity Reports

Detailed Commodity Reports and video Hot Takes from ArrowStream, for those in need of more in-depth reporting.

CommodityONE Market Report

In search of more detailed insight? Look no further than ArrowStream’s multi-page weekly CommodityONE Report.

Click the thumbnail for the latest.

April 14, 2024 – Foodservice Commodity Market Report Beef

• Cattle harvest was 559K which was lower by 22,000 head w/w and down 5.4 percent y/y

• Spot/cash cattle traded lower to $208/cwt, which was down $3/cwt since last week …

CommodityONE Hot Takes

Paul Savage, Director of Commodities at ArrowStream, presents the latest CommodityONE Hot Takes.

Click the play button to watch the latest video,

or click the thumbnails below to review archived uploads.

Past CommodityONE Updates

Foodservice Operator News

Check out insights and tips produced by experts from the Buyers Edge Platform family of brands.

- All

- Articles

- Data / Technology

- Digital Procurement Network / GPO

- Fresh Solutions / Fresh Division

- Supply Chain

5 Hidden Costs in Your Supply Chain (And How to Eliminate Them)

Source: InsideTrack

Inflation, Portions, and Labor: Cost Challenges & How Food & Supply Source Can Help

Source: Food & Supply Source

Empower Your Human Service Organization with Cost-Saving Solutions from Food & Supply Source

Source: Food & Supply Source

How Strategic Supply Chain Management Can Drive Profitability in Hospitality

Source: Source1

How Independent Restaurants Can Get Pricing Like the Big Chains

Source: Dining Alliance

How to Scale Your Restaurant Chain Without Wasting Money

Source: Consolidated Concepts

Why Foodservice Operators Need Data-Driven Tools for Commodity Management

Source: ArrowStream

Restaurant Cash Flow Management: What Every Restaurant Leader Needs to Know

Source: Back Office

Stay up to date

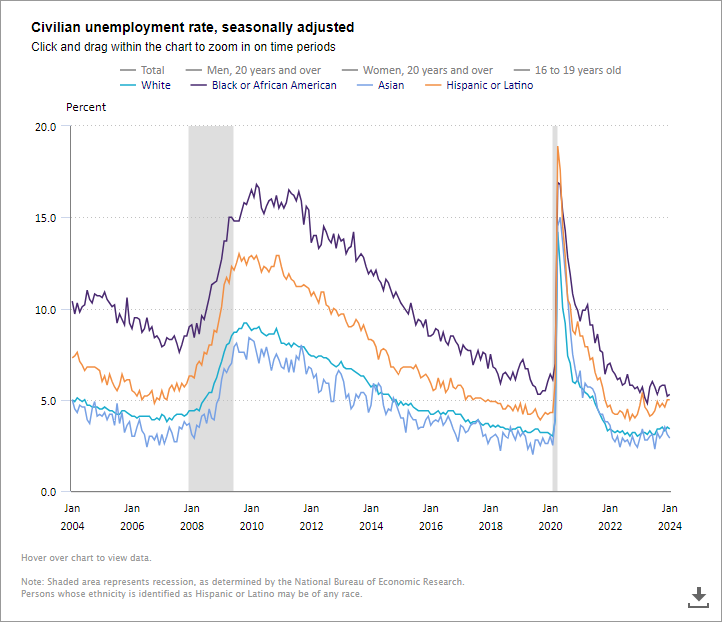

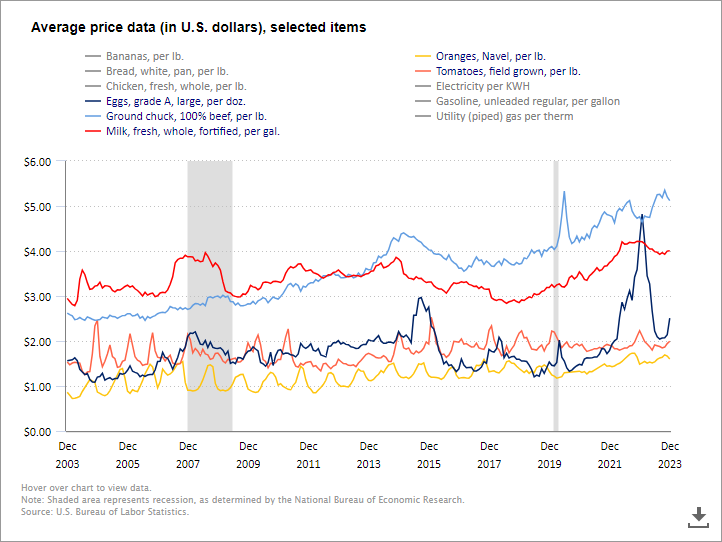

The Latest Facts & Figures

Live, interactive charts from industry experts

Monthly Economic Research From Our Partner:

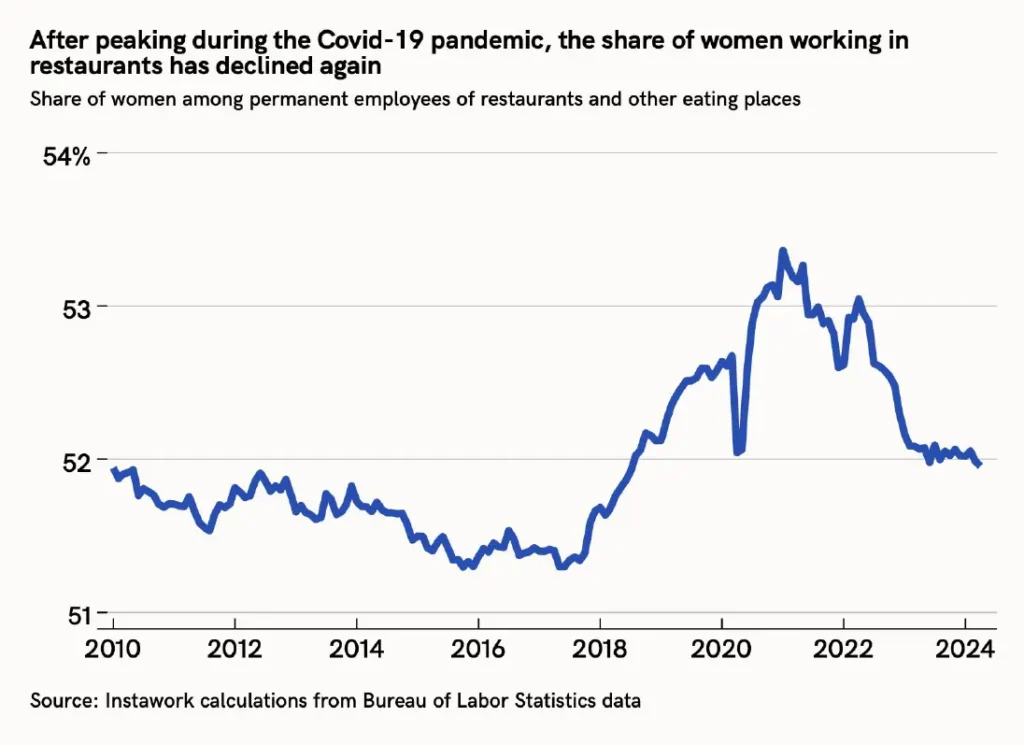

Why aren’t more women working in restaurants?

A shift to flexible schedules in the late 2010s allowed more women to work in restaurants, raising their share of employment in the industry. But since 2021, this share has dropped once again.

Click the thumbnails below to explore the latest data in each.

Then click the headings at the top to show or hide the different groups and categories.

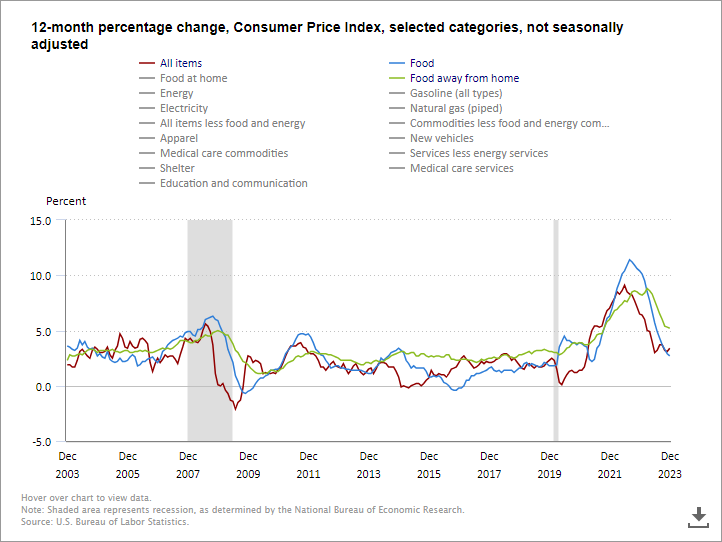

Consumer Price Index

Track the 12-month percentage changes of various goods and services.

Price Data

Track the price changes of key indicators including meat, produce and dairy.

Questions?

Contact our Team of Foodservice Experts

Submit this short form and an expert from the Buyers Edge Platform will reach back out to address your foodservice related questions or concerns.

Drop Us a Line

We will respond within 1-2 business days.